Navigating payroll in Sweden can feel like decoding a labyrinth of collective agreements, tax brackets, and compliance pitfalls. With no legal minimum wage, mandatory social contributions nearing 31.42%, and a patchwork of union-negotiated standards, missteps...

Navigating payroll in Sweden can feel like decoding a labyrinth of collective agreements, tax brackets, and compliance pitfalls. With no legal minimum wage, mandatory social contributions nearing 31.42%, and a patchwork of union-negotiated standards, missteps...

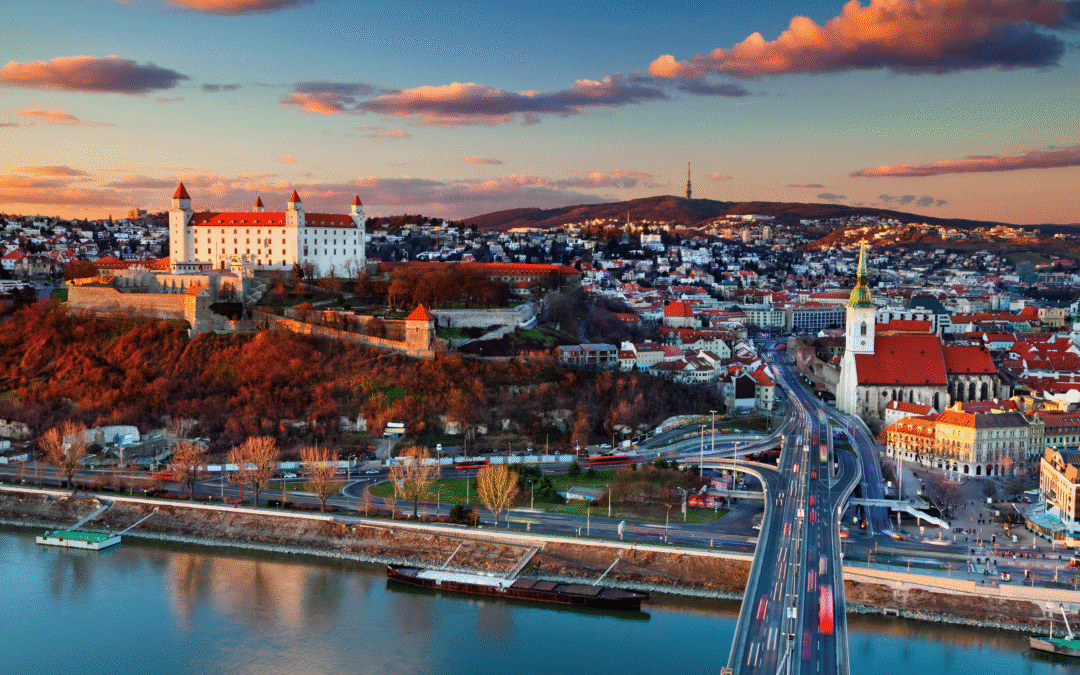

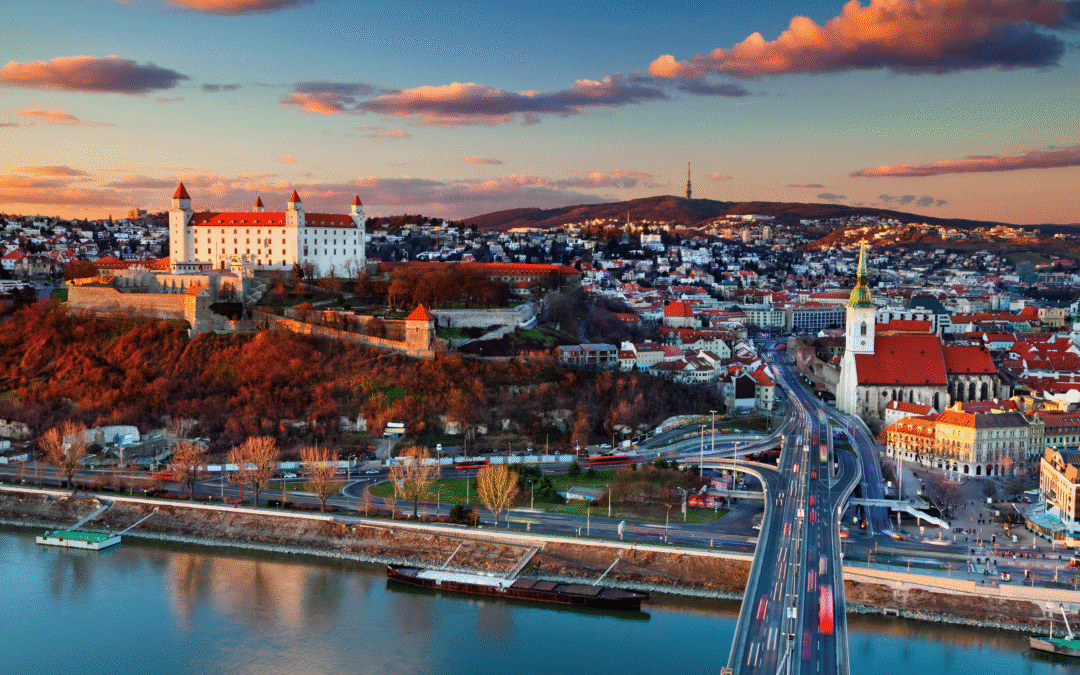

Is managing payroll in Slovakia leaving you tangled in compliance complexities and benefit obligations? Navigating Slovak payroll demands precision with employer contributions reaching 36.20% of gross salaries—which cover old-age pensions (14%), health insurance...

Is managing payroll in Slovakia leaving you tangled in compliance complexities and benefit obligations? Navigating Slovak payroll demands precision with employer contributions reaching 36.20% of gross salaries—which cover old-age pensions (14%), health insurance...

Managing payroll in Serbia can feel overwhelming for foreign businesses navigating unfamiliar regulations. How do you ensure compliance while avoiding costly errors? With a legal framework governed by the Labour Law and mandatory social security contributions,...

Managing payroll in Serbia can feel overwhelming for foreign businesses navigating unfamiliar regulations. How do you ensure compliance while avoiding costly errors? With a legal framework governed by the Labour Law and mandatory social security contributions,...

Is managing payroll in Romania leaving foreign employers overwhelmed by complex tax codes, social security obligations, and strict compliance deadlines? This guide breaks down the essentials—from the 10% flat income tax to mandatory employee and employer social...

Is managing payroll in Romania leaving foreign employers overwhelmed by complex tax codes, social security obligations, and strict compliance deadlines? This guide breaks down the essentials—from the 10% flat income tax to mandatory employee and employer social...

Struggling with payroll compliance in Lithuania? Navigating taxes, social security, and employment laws can overwhelm even seasoned businesses. This comprehensive guide covers Lithuania’s payroll essentials—from progressive income tax rates (20% up to...

Struggling with payroll compliance in Lithuania? Navigating taxes, social security, and employment laws can overwhelm even seasoned businesses. This comprehensive guide covers Lithuania’s payroll essentials—from progressive income tax rates (20% up to...